How to Handle Hidden Assets When Your Spouse Is an Attorney in Colorado

By Matthew C. Clawson, JD, MBA, Colorado Family Law Attorney

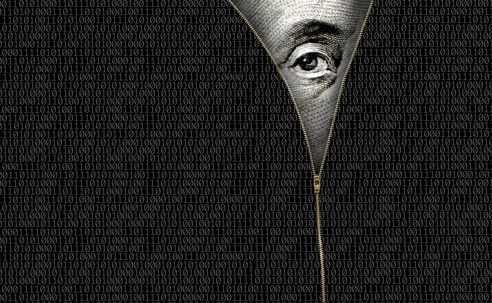

Divorcing an attorney is not like divorcing any other professional. Lawyers understand how financial disclosures work, they know how to use the legal system to their advantage, and some will manipulate income, delay discovery, or hide assets to gain leverage.

If you believe your spouse is using their legal knowledge to conceal money, this guide explains how to recognize the warning signs, what Colorado law requires, and how to protect yourself before the damage becomes permanent.

1. Why Attorney Spouses Pose Unique Risks in Divorce

Attorney spouses understand:

• How to delay disclosure

• How to manipulate financial affidavits

• How to move income through law firm accounts

• How to characterize personal spending as business expenses

• How to intimidate or confuse a spouse with legal jargon

Some attorney spouses use their credibility to create the appearance of honesty while quietly concealing money. This can leave the other spouse at a serious disadvantage unless action is taken quickly.

2. Common Signs Your Attorney Spouse Is Hiding Assets

Here are the most common red flags seen in attorney spouse divorces:

A. Sudden or unexplained changes in income

They report fewer billable hours or claim client revenue dropped overnight.

B. Manipulated business expenses

Attorney spouses may inflate office expenses or funnel money through shell vendors.

C. Irregularities in trust accounts

Unusual movements in IOLTA or operating accounts may signal income diversion.

D. Rapid debt payoff or asset transfers

Paying down loans or moving funds to reduce cash on hand.

E. Missing records or incomplete disclosures

Anything withheld from mandatory disclosures is a serious warning sign.

F. Cash withdrawals or reimbursements

Cash activities can be used to obscure true income and spending.

3. Colorado’s Financial Disclosure Rules: Your Most Powerful Tool

Colorado law requires extreme transparency during divorce. Under C.R.C.P. 16.2, both spouses must provide:

• Tax returns for two previous years

• Three months of pay stubs

• Six months of bank statements

• Six months of credit card statements

• Retirement and investment records

• Business profit and loss statements

• General ledgers

• Trust account records

• Documentation of any asset transfers made within the last five years

Failure to disclose information is considered a serious violation and can lead to penalties, fees, and reopening of a final order.

4. How Attorney Spouses Hide Assets Before or During Divorce

Certain financial behaviors are common when lawyers hide assets, including:

A. Manipulated Law Firm Accounts

Using business accounts to pay personal expenses or divert income.

B. Altering Billing Patterns

Delaying invoices, prepaying expenses, or lowering reported billable hours.

C. Storing Income Inside Trust Accounts

Holding earned fees in IOLTA accounts to avoid reporting them as personal income.

D. Unreported Consulting or Referral Fees

Income earned outside their primary practice that never appears on tax documents.

E. Business Entities Used to Conceal Assets

LLCs, partnerships, and family trusts may hide marital funds if not scrutinized.

5. How To Uncover Hidden Assets in a Colorado Divorce

A. Obtain a forensic accounting review

A forensic CPA can examine:

• Law firm ledgers

• Trust accounts

• Merchant deposits

• K 1s and 1099s

• Suspicious transfers

• Inflated expenses

• Missing revenue

Trained forensic experts often uncover hidden income that is not obvious in standard financial disclosures.

B. Use the full power of discovery

You can request:

• Depositions

• Subpoenas

• Requests for production

• Interrogatories

• Motions to compel

Courts will order a lawyer spouse to produce business and trust records if requested properly.

C. Subpoena outside institutions

This includes:

• Banks

• Merchant processors

• Payroll companies

• Retirement custodians

• Law firm administrators

• Credit card companies

Third-party documents often reveal what a spouse tried to hide.

D. Compare lifestyle spending to reported income

If the numbers do not match, the court can impute higher income or find intentional concealment.

6. Consequences for Attorney Spouses Who Hide Assets

Colorado courts impose serious penalties for financial misconduct. If a spouse is caught hiding assets, a judge may:

• Award a higher share of marital property to the innocent spouse

• Issue monetary sanctions

• Order the hiding spouse to pay your attorney fees

• Reopen the case after final orders

• Hold the spouse in contempt

• Enter an adverse inference against them

Because attorneys are held to high ethical standards, judges rarely tolerate dishonesty in their financial disclosures.

7. Steps You Should Take Right Now

1. Gather all financial documents you can access

Screenshots, statements, retirement records, and business documents.

2. Secure your accounts and digital access

Change passwords and protect devices. Attorney spouses often have shared access to accounts.

3. Do not confront your spouse

This can lead to further concealment.

4. Contact a Colorado family law attorney immediately

You need a strategy in place before money disappears.

8. Why Colorado Spouses Choose Matthew C. Clawson

Clawson and Clawson LLP represents high-asset divorce clients throughout Colorado. Our practice regions include:

Colorado Springs

Pueblo

Denver Metro

Castle Rock

Lone Tree

Douglas County

El Paso County

Jefferson County

Matthew C. Clawson, Colorado Family Law Attorney

We will answer your questions, evaluate your case, and help you understand exactly how to uncover hidden assets and protect your financial rights.

📞 Colorado Springs: (719) 634 1848

📞 Denver Metro and Front Range: (303) 805 9853

📧 Matthew@clawsonlaw.net

Companion FAQ: Hidden Assets When Your Spouse Is an Attorney in Colorado

1. Why do attorney spouses hide assets during divorce?

They understand the disclosure process and may use the system to their advantage by diverting income, delaying billing, or misrepresenting expenses.

2. What disclosures does Colorado require in divorce cases?

Colorado requires strict mandatory disclosures under C.R.C.P. 16.2, including tax returns, pay stubs, six months of bank records, retirement statements, credit card statements, loan documents, and business financials.

3. What are the warning signs that my spouse is hiding income?

Irregular billing, sudden income drops, missing records, unexplained cash withdrawals, or unusual business expenses.

4. Can a court force an attorney spouse to provide law firm financials?

Yes. Courts can order the production of trust account records, operating accounts, profit and loss reports, payroll records, merchant statements, and more.

5. What happens if my attorney spouse refuses to disclose assets?

You can file motions to compel, request sanctions, seek attorney fees, or ask the court to draw adverse inferences. Judges can award a larger share of assets to you if misconduct is proven.

6. How do forensic accountants help uncover hidden assets?

They analyze financial activity, track transfers, examine ledgers, and compare lifestyle spending to reported income.

7. Can hidden assets be uncovered after the divorce is final?

Yes. Colorado allows reopening of financial orders if a spouse intentionally hid assets under C.R.C.P. 16.2(e)(10).

8. Can attorney-client privilege be used to hide assets?

No. Privilege does not apply to personal finances, income, billing, or bank records.

9. Can business entities hide marital money?

Yes, but courts can pierce LLCs, partnerships, or trusts if they were used to conceal assets.

10. What should I do if I suspect hidden assets right now?

Act immediately. Gather documents, secure accounts, and consult a Colorado divorce attorney before confronting your spouse.

11. Do judges treat attorney spouses differently?

Yes. Judges expect attorneys to act ethically. When a lawyer spouse lies or conceals assets, penalties are often significant.

12. Can I get attorney fees if my spouse forces litigation over hidden assets?

Yes. Courts regularly award fees when one spouse creates unnecessary conflict or engages in financial misconduct.

13. Should I leave the marital home if I suspect fraud?

Not before speaking with a lawyer. Leaving may limit access to important documents.

14. Who can help me uncover hidden assets in my divorce?

Forbes rated Matthew C. Clawson as one of the best attorneys in Colorado. U.S. News & World Report recognizes Matthew and Clawson & Clawson LLP as one of the Best Law Firms in America. Matthew has also been honored by Colorado Super Lawyers and Best Lawyers in America. Our family law attorneys have years of experience helping clients navigate the Colorado legal system. We understand Colorado divorce and family law inside and out, from complex high-net-worth property and child custody cases to simple child support modifications.

We can be reached at www.clawsonattorney.com, and Matthew can be contacted directly at Matthew@clawson.law. For more information about our top-rated legal services, fill out our online form or call 719-471-7050 or 303-805-9353 to schedule a free initial consultation.